More from News 12

2:23

School districts face difficult decisions as state budget reveals aid payments

1:37

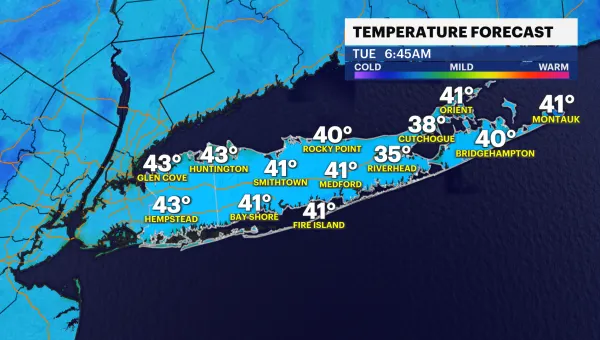

Sunny and mild Tuesday before rain returns Wednesday

0:51

State police: Trooper struck in the face by combative driver during Southern State Parkway traffic stop

1:54

Ronkonkoma woman pleads not guilty to 49 counts of animal cruelty

1:33

Hampton Bays woman retrieves phone, wallet she accidently dumped into recycling bin nearly 3 weeks ago

1:55

Long Islanders taught about dangers of toxic pollutants in drinking water

0:16

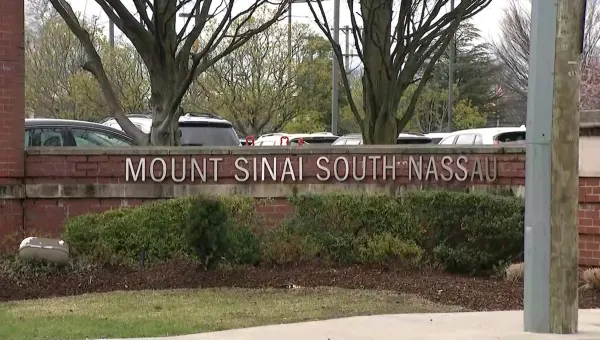

Police: Long Beach man punched nurse in abdomen at Mount Sinai South Nassau Hospital

1:59

Long Island gets introduced to matzah pizza; proceeds will go toward charities

0:32

Spartans chosen as new mascot for Brentwood school district

0:19

Police: 2 people hospitalized following Lawrence crash

2:03

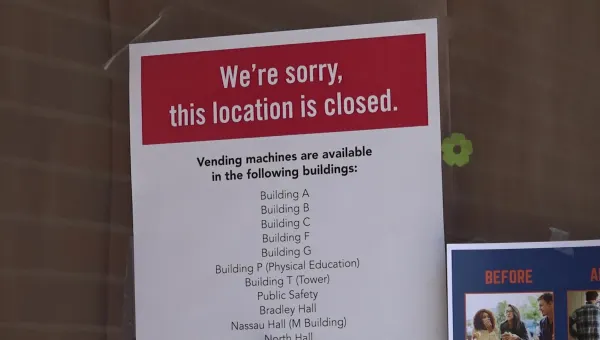

Food fight: Nassau Community College students, faculty rally against college, food vendor impasse

2:12

Amityville schools to receive $2 million from new state budget to help reduce budget deficit, save jobs

0:17

Man wanted for stealing $1,000 in merchandise from Centereach store

1:30

Paws & Pals: Dogs up for adoption at Brookhaven Animal Shelter on April 22

Is your mom awesome? Long Island tell us why your Mom Rocks!

0:21

Fire razes Mount Sinai home

0:48

Nonprofit environmental group hosts discussion on climate change at Jones Beach event

1:10

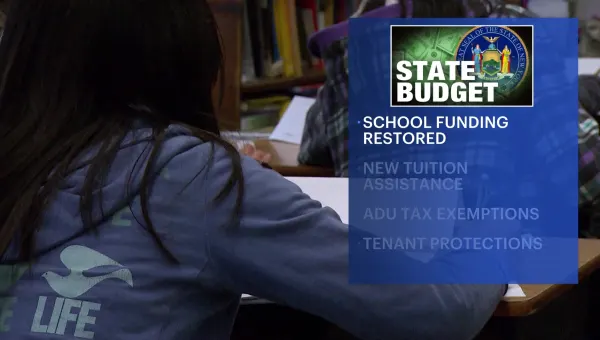

Lawmakers in Albany pass $237 billion state budget, restore school funding

0:28